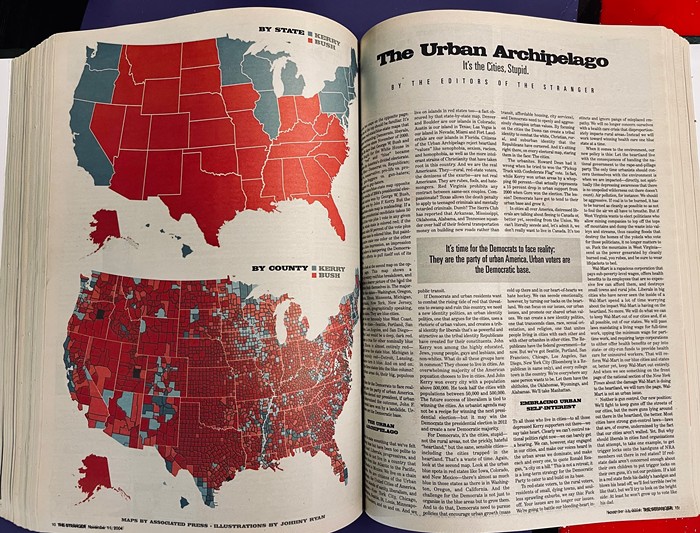

*White Seattle loosens tie, looks around nervously, dabs sweat from brow, exhales deeply.* Kidding aside, Alana Semuels' long, well-researched, and well-argued study goes deep into the historic intention of segregation, and its long-term effects. This piece will be of interest to anyone concerned with urban planning, history, demography, and the undeniable fact that much of America was designed as a fortress for white solitude. Those plans were rendered untenable (as well as inept) by the forces of morality, reality, and economy a very long time ago. The Trump campaign is predicated on the lie that they can and should be restored, that they were not only not a long-misbegotten folly, but that they were the glory days. Fuck that. Read this.

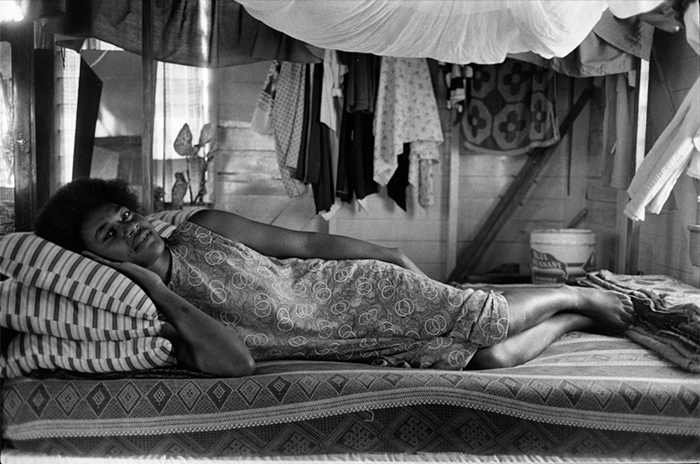

The urban-renewal efforts made it difficult for black residents to maintain a close-knit community; the institutions that they frequented kept getting displaced. In Portland, according to Gibson, a generation of black people had grown up hearing about the “wicked white people who took away their neighborhoods.” In the meantime, displaced African Americans couldn’t acquire new property or land. Redlining, the process of denying loans to people who lived in certain areas, flourished in Portland in the 1970s and 1980s. An investigation by The Oregonian published in 1990 revealed that all the banks in Portland together had made just 10 mortgage loans in a four-census-tract area in the heart of Albina in the course of a year. That was one-tenth the average number of loans in similarly-sized census tracts in the rest of the city. The lack of available capital gave way to scams: A predatory lending institution called Dominion Capital, The Oregonian alleged, also “sold” dilapidated homes to buyers in Albina, though the text of the contracts revealed that Dominion actually kept ownership of the properties, and most of the contracts were structured as balloon mortgages that allowed Dominion to evict buyers shortly after they’d moved in. Other lenders simply refused to give loans on properties worth less than $40,000. (The state's attorney general sued Dominion’s owners after The Oregonian's story ran; the AP reported that the parties reached a settlement in 1993 in which Dominion’s owners agreed to pay fines and to limit their business activity in the state. The company filed for bankruptcy a few days after the state lawsuit was filed; U.S. bankruptcy court handed control of the company to a trustee in 1991.)